update on mn unemployment tax refund

How they affect you Last updated. Minnesota Unemployment Refund Update.

Minnesota Lawmakers Finish Deal On Unemployment Bonuses Www Wdio Com

Minnesota Department of Revenue Mail Station 0020 600 N.

. Minnesota Unemployment Benefits Fraud Report. Tim Walz signed Frontline Worker Payments. - The Minnesota Department of Revenue announced today that the processing of nearly 540000 tax returns impacted by changes made only to the treatment of Unemployment Insurance UI compensation andor Paycheck Protection Program PPP loan forgiveness is complete.

It is estimated that more than 540000 Minnesotans are eligible for the COVID-19 tax refunds as a result of these tax cuts passed in. 22 2022 Published 742 am. Unemployment tax changes.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. Why are you getting this. Minnesota Law 268044 Subd1.

2014 Tax Rate Reduction for Employers. For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law. Mail your income tax return to.

The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020. If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an additional refund. Applications are open and will be accepted through July 22 2022 at 5 pm.

2022 New employer rates. Pass-through entities do not need to amend their 2020 Minnesota return to update their Schedule KPI KPC or KS solely due to those tax law changes. H undreds of thousands of Minnesotans are receiving surprise checks issued by the Minnesota Department of Revenue for Americans who paid state tax on unemployment benefits.

On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt. Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically.

Minnesota Department of Revenue Mail Station 5510 600. September 15 2021 by Sara Beavers. Reports must be received on or before the last day of the month following the end of the calendar quarter.

Get Help redirect News. People who received unemployment benefits last year and filed tax. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

The Taxable wage base for 2022 is 38000. 2022 Base Tax Rate changed from 050 to 010 2022 Additional Assessment changed from 1400 to 000. By Anuradha Garg.

Special Assessment Federal Loan Interest Assessment for 2022 from 180 to 000. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. In the latest batch of refunds announced in November however the average was 1189.

Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. Revenue and MNIT staff have been working through the summer and early fall to update 2020 tax forms to reflect the law changes made in July develop and build a system that is able to adjust over 540000 impacted returns and test that system to ensure the correct refund is issued including additional benefits that may be due because of the. We know these refunds are important to those taxpayers who have experienced hardships over the last year and a half.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. They fully paid and paid their state unemployment taxes on time. About 560000 tax returns are impacted by the change which was the last bill to clear the state capitol during special sessionGov.

Law Change FAQs for Tax Year 2021 updated 11422 Tax Year 2020. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

Paul MN 55145-0020 Mail your tax questions to. The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness. The new law reduces the.

Additional Assessment for 2022 from 1400 to 000. How they affect you. The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds that have been delayed due to tax law changes.

The department has. 61722 at 230 pm. On September 13th the.

Minnesota Department of Revenue Mail Station 0010 600 N. The department sent out over 300 million in the form of refunds or a. Base Tax Rate for 2022 from 050 to 010.

The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. Some of the information on the following FAQ pages may be outdated due to Minnesota tax law changes enacted July 1 2021. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th.

For more information on this new law refer to Unemployment tax changes. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. 2020 Individual and Business Tax Form Updates.

Fees and penalties. Credit adjustments refunds. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Law Change FAQs for 2020 updated 101021 Webinar Script September 15 2020. The Department of Labor has not designated their state as a credit. Employers with an active employer account must submit a wage detail.

CTScroll down and click Minnesota Frontline Worker Pay Program in your preferred language to begin your applicationAbout Frontline Worker PayTo thank those Minnesotans who worked on the frontlines during the COVID-19 peacetime emergency Gov. Are the Economic Injury Disaster Loans EIDL taxable in Minnesota for 2020. Paul MN 55145-0010 Mail your property tax refund return to.

The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. The Minnesota Department of Revenue has confirmed the processing of returns impacted by recent tax changes for those who collected unemployment insurance compensation and Paycheck Protection Program loan forgiveness.

When Will Irs Send Unemployment Tax Refunds Wbir Com

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Update Gov Walz Signs Bill On Unemployment Insurance Bonus Checks For Frontline Workers Fox21online

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Minnesota Guidance On Federal Unemployment Compensation Exclusion

Many Minnesotans Will See Automatic Tax Refunds Soon After Legislative Deal

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Labor Market Trends During The Pandemic Recession Jobs Vacancies Unemployment And Labor Force Participation In Minnesota Minnesota Department Of Employment And Economic Development

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

How To Get A Refund For Taxes On Unemployment Benefits Solid State

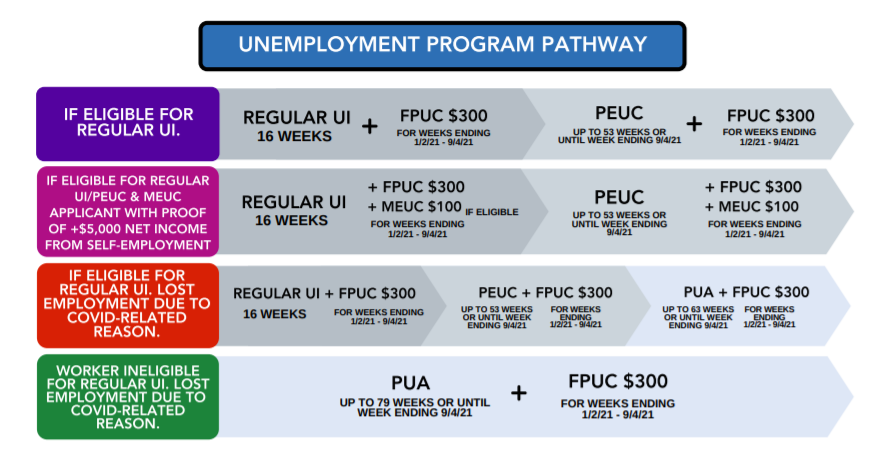

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Mn Revises 2022 Unemployment Insurance Tax Rates Paylocity

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Legislative Update September 3 2021

How To Get A Refund For Taxes On Unemployment Benefits Solid State

1099 G Unemployment Compensation 1099g

Labor Market Trends During The Pandemic Recession Jobs Vacancies Unemployment And Labor Force Participation In Minnesota Minnesota Department Of Employment And Economic Development